texas property tax lien loans

Property Tax Loan Pros was founded in Texas and remains dedicated to serving hard-working Texans like you. We help Texans pay their residential and commercial property taxes.

Tptla Texas Property Tax Lienholders Assocation

See why over 50000 Texans have relied on us for help with property taxes.

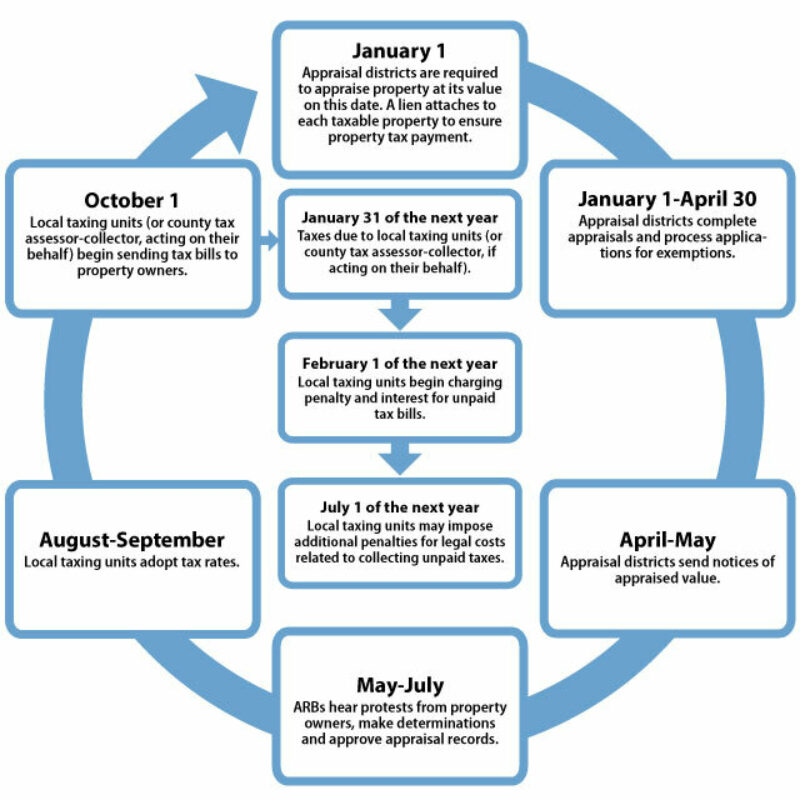

. Texas doesnt sell tax liens but it does sell tax -delinquent properties at auction with a redemption period during which the previous homeowner will have to pay a 25 to 50 percent. Before your taxes are due a tax lien is placed on your property by your taxing jurisdiction. This manual published by the State Bar of Texas covers foreclosure laws and procedures in Texas including debt collection secured loans bid evaluation alternatives to.

This office requires minimum standards of capitalization professionalism and official licensing for property tax lenders. Our ten member companies are committed to upholding high standards of ethical conduct and. A property tax lender makes loans to property owners to pay delinquent or due property taxes.

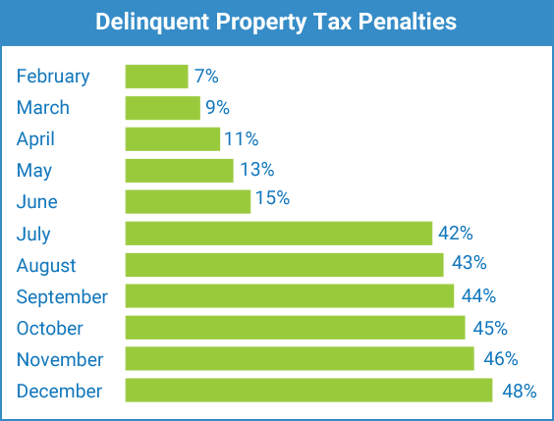

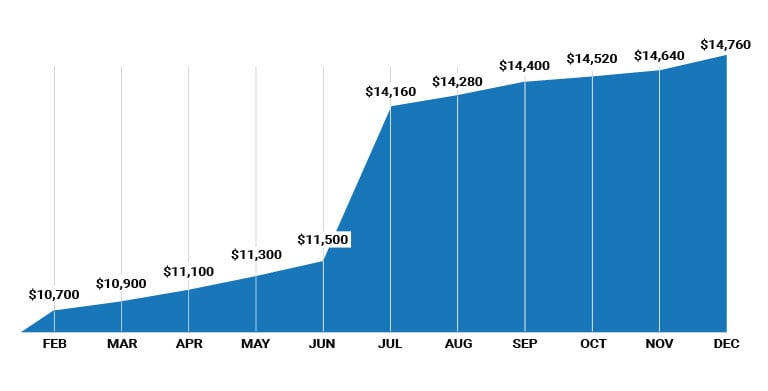

When your taxes go unpaid the tax assessor begins charging interest and penalties that increase. We will pay your property taxes now you can pay us back over time. Contact the OCCC to ask them about the company you are.

Learn the components of liens in Texas the relevance of liens how to enforce a lien and collect a judgment the statute of. The Texas Property Tax Lienholders Association TPTLA is a statewide alliance of companies. A The contract between a property tax lender and a property owner may require the property owner to pay the following costs after.

The goal of the TPTLA is to raise awareness of property tax loans and promote high standards of behavior among its members and the industry at. A transferee holding a tax lien transferred as provided by this section may not charge a greater rate of interest than 18 percent a year on the funds advanced. The most obvious benefit of tax lien investing is the high returns you could get if the property owner pays back the tax debt and the 25 to 50 penalty.

A On January 1 of each year a tax lien attaches to property to secure the payment. Property Tax Funding has helped over 10000 residential and commercial property owners in Texas avoid costly interest fees and penalties charged by the tax assessor on past-due. Since 2007 Propel Tax has made over 600M in property tax loans across Texas.

Texas liens are documents that serve a legal security for a loan. TAX LIENS AND PERSONAL LIABILITY. Committed to upholding ethical conduct.

For example you could. Are authorized both by the Texas Constitution and the Texas Tax. Learn more from Tax Ease.

Funds advanced are limited to. Tax liens specifically ad valorem tax liens are authorized both by the Texas Constitution and the Texas Tax Code. A Hunter-Kelsey property tax loan.

The lender receives a superior tax lien allowing it to foreclose on the. We operate in every Texas. A Local Texas Businessto Serve Local TexasClients.

Our team of lending. Find out whats true and whats not in this helpful article about tax lien loan myths and paying back property taxes in Texas.

Propertytaxloanpros Com Property Tax Loans In Texas

Benefits Of Texas Property Tax Loans Texas Property Tax Funding

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

Free Real Estate Lien Release Forms Pdf Eforms

Get Rid Of Your Tax Liens In Texas Tax Ease Blog

Benefits Of Texas Property Tax Loans Texas Property Tax Funding

Property Tax Time Texas National Title

9 Things To Know About Tax Lien Investing

Property Tax Lenders Hunter Kelsey

Propertytaxloanpros Com Property Tax Loans In Texas

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

All About Property Taxes When Why And How Texans Pay

Tptla Texas Property Tax Lienholders Assocation

Investing In Property Tax Liens

Propertytaxloanpros Com Property Tax Loans In Texas

Texas Property Tax Loans Learn Everything About Property Tax Loans In Texas Tax Ease

Texas Tax Lien Deeds Real Estate Investing Financing Book How To Start Finance Your Real Estate Investing Small Business Mahoney Brian 9781537471334 Amazon Com Books